Open Acquiring: What do they do?

Open Acquiring (OPAC) is a merchant management and payment orchestration platform built to simplify how businesses handle global payments. It allows enterprises, SMEs, and PSPs to manage merchant onboarding, transactions, invoicing, risk monitoring, analytics, and recurring payments—all from a unified dashboard.

The goal of this project was to create a scalable, intuitive, and data-rich experience for financial operators and merchants. The platform had to deliver real-time insights, reduce operational friction, and maintain trust by ensuring transparency in risk and compliance.

The Challenge

Businesses dealing with multi-channel payments face significant challenges:

- Fragmented dashboards across multiple processors and payment gateways.

- Limited visibility into risk, chargebacks, and fraud trends.

- Difficulty reconciling recurring payments and invoices.

- Lack of a centralized system for merchant onboarding and monitoring.

- Overwhelming transaction data without clear insights.

The challenge was to design a platform that not only consolidated these functions but also ensured clarity, scalability, and usability for diverse user roles—from analysts and risk managers to merchants and admins.

The Solution

Our solution was to design Open Acquiring as a unified merchant services dashboard that simplifies payment operations and risk management. It offers real-time transaction tracking, fraud detection, automated invoicing, and rich analytics, while the guided setup wizard streamlines onboarding and role-based access ensures secure multi-user control.

Design Process

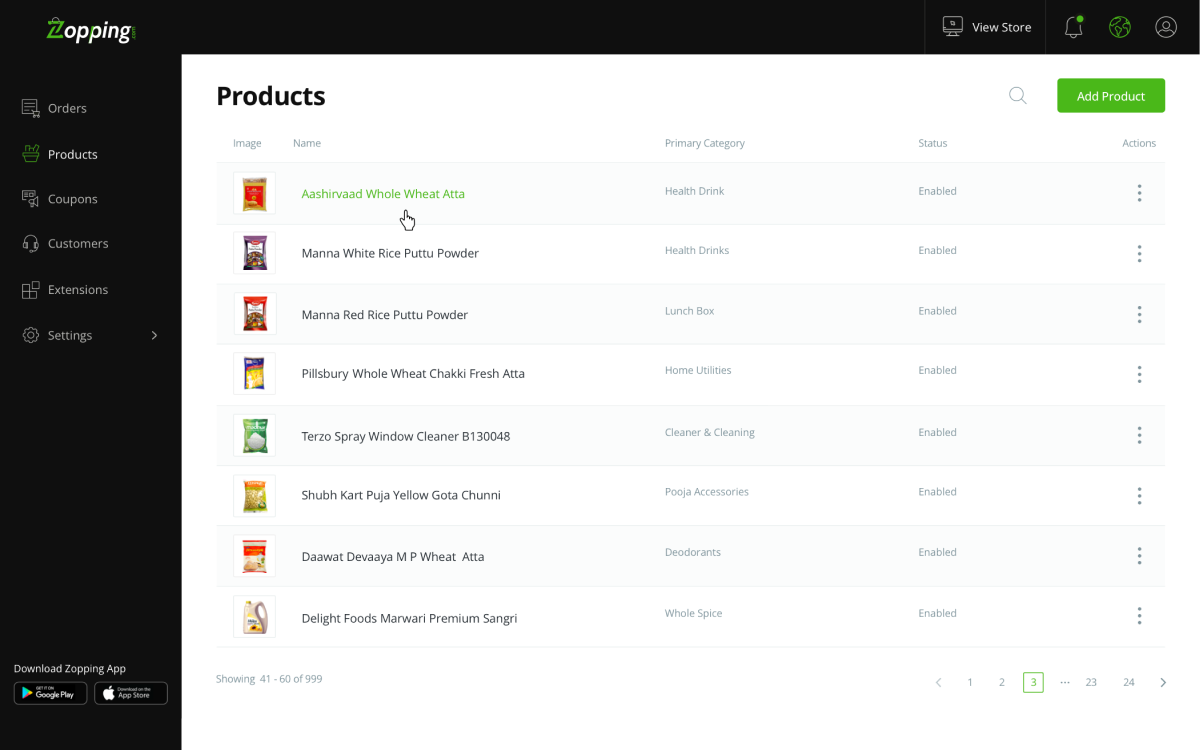

In the design process, we began with stakeholder workshops and research on existing merchant management systems, which revealed a need for data-rich yet uncluttered dashboards, quick fraud alerts for risk managers, and a guided onboarding flow for merchants. We structured the information architecture around core modules—Dashboard, Transactions, Risk Engine, Invoicing, Analytics, and Merchant Setup—to create a logical user flow. Low-fidelity wireframes helped validate navigation, later refined into high-fidelity mockups with clean visuals and strong data visualization. Finally, interactive prototypes were tested with finance operators and merchants, leading to iterations that simplified tables, improved filters, and clarified the visual hierarchy of transaction data.

Key Features Designed

Dashboard

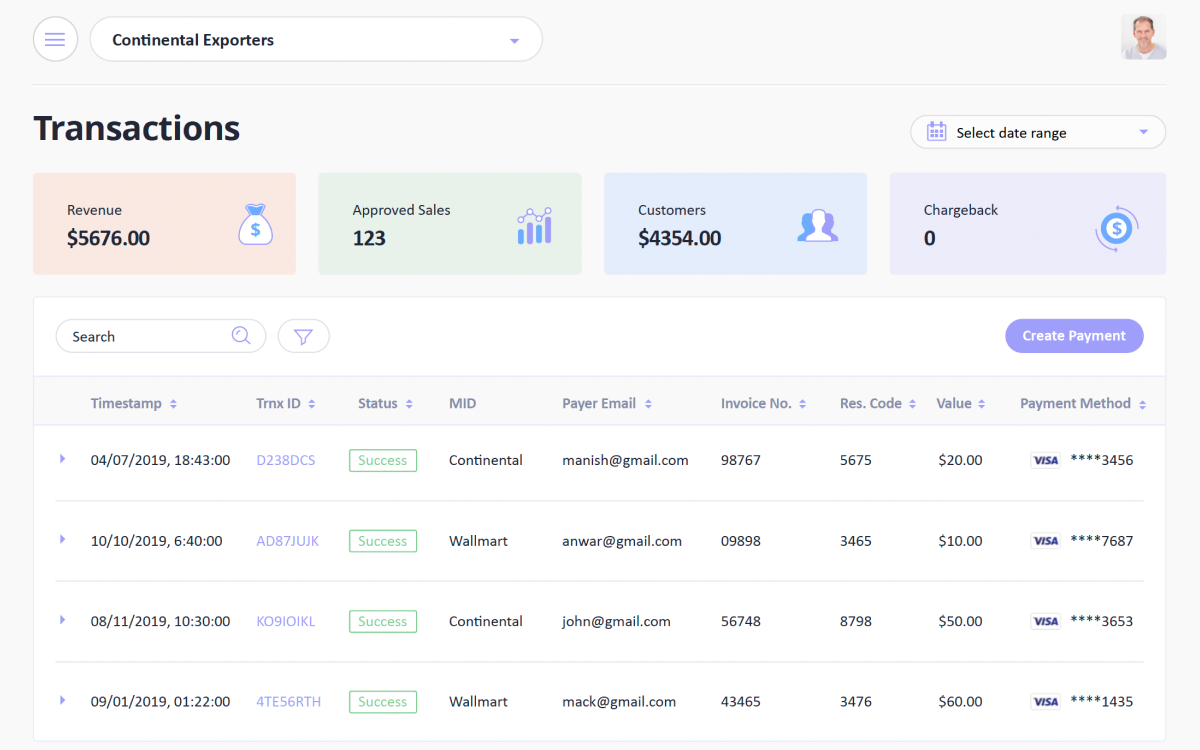

Revenue KPIs, approval ratios, chargeback count, and payment method distribution.

Transactions

Detailed logs with filtering, search, and batch exports.

Risk Engine

Chargeback analysis, fraud monitoring, flagged volume tracking, BIN trending.

Invoicing

Batch upload, invoice creation, multi-currency support, recurring billing.

Analytics

Real-time graphs for refunds, chargebacks, demographics, and trend monitoring.

Merchant Setup Wizard

Step-by-step onboarding—business info, bank setup, website integration, pricing profile, and processor management.

User Management

Role-based access, merchant admin controls, and API key management.

Performance Leap

Outcome

The OPAC platform was successfully adopted by multiple merchants and enterprises, offering them a centralized, transparent, and user-friendly ecosystem for managing payments and risks. The design elevated trust in financial workflows and positioned OPAC as a scalable fintech solution for global commerce.

GoUI/UX for Open Acquiring

- Users could monitor thousands of transactions in real time with simplified data visualization.

-

The wizard reduced merchant setup time by 40%.

- Multi-currency invoicing and payment processor cascading supported international scaling.